Vancouver, British Columbia – Ero Copper Corp. (the “Company”) (TSX: ERO) is pleased to provide a quarterly update on the ongoing exploration drill programs on its 99.6% owned Vale do Curaçá Property located in Bahia State, Brazil, and on its 97.6% owned NX Gold Mine located in Mato Grosso State, Brazil. This update encompasses drill results received from the end of March through to the end of May, 2019. Exploration drilling during the period was focused primarily on upgrade and infill drilling ahead of the Company’s updated National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant technical report and mine plan, expected to be completed early in the fourth quarter of 2019.

HIGHLIGHTS

Highest grade-meter intercept drilled to date by the Company on the Vale do Curaçá Property at the Vermelhos Mine, intersecting 28.1 meters grading 12.60% copper including 18.0 meters grading 15.62% copper;

Initial drilling beneath the main orebodies of the Vermelhos Mine encountered high-grade mineralization approximately 70 meters below the Toboggan orebody, intersecting 13.4 meters grading 5.86% copper including 8.4 meters grading 7.04% copper from 306.3 meters down hole;

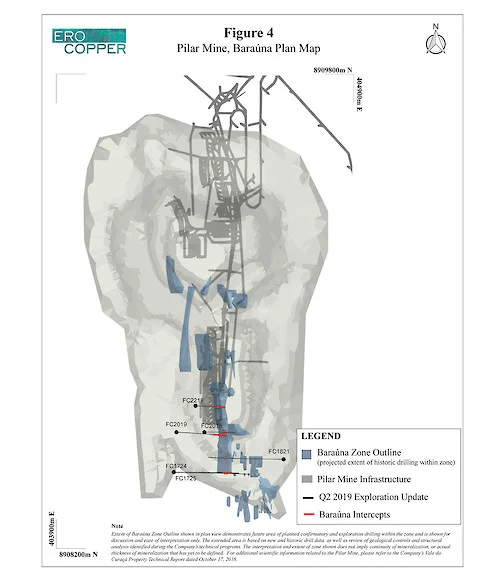

New mineralized zone, Baraúna, discovered at Pilar Mine, immediately below southern portion of the historic open pit;

Continued delineation of newly discovered Santo Antonio vein at NX Gold highlighted by hole SA49 that intersected 2.9 meters grading 30.33 grams per tonne gold.

Twenty six drill rigs are now operating throughout the Curaçá Valley, including 13 within the Vermelhos District and 13 within the Pilar District. Three of these drill rigs are testing high-priority regional exploration targets located within these districts. In addition, a truck-mounted drill rig, which will focus on expediting regional exploration drilling, has just arrived on site and will be mobilized in the coming weeks. There are seven drill rigs operating at the NX Gold Mine.

David Strang, President and CEO of the Company commented, “The latest results from our ongoing exploration programs continue to highlight significant opportunities for expansion of the known mineral resources around our operating mines. In particular, we are impressed by the drill results at the Vermelhos Mine where we continue to see very high grades over significant widths, including one of the highest grade-meter holes drilled to date. We are excited by the new high-grade mineralization encountered approximately 70 meters below the Toboggan orebody, but cautious to draw any definitive conclusions from this single intercept until we have further evaluated the surrounding area with two newly mobilized underground drill rigs.

The new Baraúna discovery at the Pilar Mine continues to speak to the great work our geology teams are doing in compiling nearly 50 years of historic data into a modern database. Along with the West Limb and East zone discoveries, the newly identified Baraúna zone increases our confidence that we will continue to extend the mine’s life for years to come. The near-surface nature of the Baraúna discovery in relation to the past producing open pit mine may, following detailed engineering, support reopening portions of the open pit to mining in the future.”

SUMMARY

Within the Vermelhos District, where 13 drill rigs are currently operating including 11 focused on resource upgrade and exploration programs within and adjacent to the Vermelhos Mine, drill results during the period continue to demonstrate the potential for increasing the known limits of mineralization within the mine.

Recent infill drilling of the Toboggan orebody intersected some of the highest grades drilled to date at Vermelhos, highlighted by hole FVS-393 that intersected 32.0 meters grading 8.12% copper including 13.0 meters grading 13.35% copper and hole FVS-394 that intersected 28.1 meters grading 12.60% copper including 18.0 meters grading 15.62% copper – the latter representing the highest grade-meter intercept drilled to date in the Curaçá Valley by the Company. In addition to being high-grade, these holes represent an approximately 40% increase in the modeled thickness of mineralization in the immediate area surrounding these results.

Also within the Vermelhos Mine, the first hole targeting mineralization beneath the previous known extent of the main Vermelhos orebodies intercepted several mineralized lenses including a significant massive-sulphide intercept approximately 70 meters beneath the Toboggan orebody. While the significance of a single drill hole is limited, the intercept in hole FVS-465 of 13.4 meters grading 5.86% copper including 8.4 meters grading 7.04% copper from 306.3 meters down hole, opens the area immediately beneath the existing infrastructure of the Vermelhos Mine for potential new zones of high-grade mineralization. Two underground drill rigs have started programs that will test for mineralization beneath the main orebodies.

Regionally within the Vermelhos District, exploration drilling is now focused on a north-northeast mineralized trend encompassing the Vermelhos Mine, East Zone, N8 Deposit and several high-priority regional targets located south and to the north of the Vermelhos Mine – a combined strike length of approximately 5.5 kilometers. There are two drill rigs operating on these regional targets.

Within the Pilar District, where 13 drill rigs are currently operating, including 12 focused on upgrade and exploration programs within and adjacent to the Pilar Mine, a new mineralized zone was discovered beneath the south portion of the historic Pilar Mine, as well as expansions of mineralization within the underground mine adjacent to the existing mining operations and infrastructure.

Ongoing analysis of historical data has identified a new zone of mineralization extending from below the southern portion of the historic Pilar open pit mine. The new zone, called Baraúna, consists of a historic database of over 75 drill holes. During the period, six confirmatory holes were drilled into the newly discovered zone, which to-date has been delineated over a north-south strike length of approximately 450 meters, varying thickness of up to 30 meters and has been interpreted as extending from outcrop at the bottom of the open pit and connecting to mineralization at depth in the Pilar Mine. Current drilling is focused on mineralization above level -157, or approximately 110 meters from the bottom of the open pit. Drill results during the period are highlighted by hole FC2218 that intersected 51.6 meters grading 1.33% copper and hole FC2019 that intersected 46.0 meters grading 1.18% copper.

Within the Pilar underground mine, new drilling of the South Extension from a newly accessed drill station located on level -174, has delineated a wide zone of mineralization previously modeled as narrow lenses at the southern edge of the orebody. Drilling during the period resulted in a significant expansion of this zone in both thickness and grade in the immediate area of these results, and is highlighted by hole FC3264 that intersected 21.0 meters grading 1.41% copper including 4.0 meters grading 3.54% copper and 31.9 meters grading 2.78% copper including 3.0 meters grading 5.63% copper.

Additionally, in the Pilar underground mine, a grouping of deep holes drilled in the Deepening Extension, including the deepest hole drilled to date (FC4885) encountered high-grade copper mineralization. The results are highlighted by hole FC4885 that intersected 8.4 meters grading 4.02% copper and 6.9 meters grading 3.15% copper approximately 40 meters below the previously known deepest intercept.

At the NX Gold Mine, where seven exploration drill rigs are currently operating, drilling is focused on infill and extensional drilling of the previously announced Santo Antonio discovery (see press release dated April 18, 2019) in preparation of the Company’s updated NI 43-101 compliant technical report and mine plan expected to be released during the fourth quarter. Santo Antonio results during the period are highlighted by hole SA49 that intersected 2.9 meters grading 30.33 grams per tonne gold.

Expansions and extensions as referenced herein reflect mineralization not captured in the Company’s mineral resource and mineral reserve models used in the current NI 43-101 compliant mineral resource and reserves. Currently, 26 drill rigs are operating within the Curaçá Valley and seven drill rigs are operating at the NX Gold Mine.

VERMELHOS DISTRICT

The Vermelhos District is located approximately 80 kilometers to the north of the Pilar Mine and Caraíba Mill complex and includes the operating high-grade Vermelhos Mine. Drilling is focused on upgrading, expansion and new discovery initiatives within and immediately adjacent to the Vermelhos Mine. In addition, drilling to evaluate regional targets identified during the Company’s regional airborne survey and subsequent data compilation work of the broader Vermelhos system – a north-south trend encompassing the Vermelhos Mine, East Zone and the N8 Deposit that extends over 5.5 kilometers in strike length – is underway.

Thirteen drill rigs are currently operating in the district including 11 focused on resource upgrade and exploration programs within and adjacent to the Vermelhos Mine, while two rigs are focused on regional targets. Drill rigs in the District are comprised of three underground drill rigs and 10 surface drill rigs.

Vermelhos Main Orebody Expansions

While the majority of drilling performed at the Vermelhos Mine during the period was conducted for purposes of upgrading previously defined mineral resources, stope definition and mine planning, two recent drill holes resulted in a significant central expansion of the Toboggan orebody as compared to previously modeled thickness. The results are highlighted by hole FVS-393 that intersected 32.0 meters grading 8.12% copper including 13.0 meters grading 13.35% copper and hole FVS-394 that intersected 28.1 meters grading 12.60% copper including 18.0 meters grading 15.62% copper. In addition to being amongst the highest grade-meter intercepts drilled by the Company in the Curaçá Valley to date, the mineralized thicknesses of these intercepts are significant as, together, they represent an approximate 40% increase in the modeled thickness in the immediate area surrounding these holes as compared to the current mineral resource and reserve estimate.

In addition, deeper drilling at Vermelhos based on new geological information, supported by underground mapping, was undertaken immediately beneath the Toboggan orebody. The first hole drilled in this program intercepted several mineralized lenses including significant massive sulphide mineralization located approximately 70 meters below the known extent of the Toboggan orebody in hole FVS-465 that intersected 13.4 meters grading 5.86% copper from 306.3 meters down hole. While the significance of any single drill hole is limited, this is the first evidence of massive-sulphide mineralization beneath the main Vermelhos orebodies and reinforces the potential for additional high-grade massive-sulphide mineralization within the Vermelhos system. Two underground drill rigs have started programs that will test for continuity of mineralization beneath the main orebodies.

Please see Figure 1 for drill collar locations, Figure 2 for a north-south long section and Figure 3 for an east-west cross-section of the Vermelhos Mine and hole FVS-465.

NSI indicates no significant intercept, based on cut-off grade of 0.68% copper. Drill holes were drilled from surface. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

Vermelhos East Zone Extension

The Vermelhos East Zone discovery (see press release dated September 25, 2018 for announcement of the Vermelhos East Zone discovery) is located approximately 100 meters to the east of mineralization comprising the main Vermelhos Mine orebodies and lies on the eastern side of an intrusive body. The zone of mineralization, to date, has been delineated from surface copper oxide mineralization to an interpreted depth of approximately 500 meters below surface.

During the period, results from seven drill holes were received, four of which highlight extensions of the Vermelhos East Zone. These results include the first results from three reverse circulation (“RC”) holes drilled to the north-east of the Vermelhos Mine, primarily to conduct down-hole EM surveys in the area, and two of these holes resulted in thick mineralized intercepts. The results are highlighted by drill hole CRN7-141 that intersected 52.0 meters grading 0.80% copper. Please see Figure 1 for collar locations and Figure 2 for a north-south long section of the Vermelhos Mine including the Vermelhos East Zone.

NSI indicates no significant intercept, based on cut-off grade of 0.68% copper. Drill holes were drilled from surface except for hole FVS-430 which was drilled from level +245 in the Vermelhos Mine. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter. (*) indicates a RC drill hole.

PILAR DISTRICT

The Pilar District encompasses the area surrounding the Pilar underground mine, Caraíba Mill complex and the past producing Pilar open pit and R22 Mines. Thirteen drill rigs, including eight focused on resource upgrade and exploration programs within the Pilar Mine, are currently operating within the District. These are comprised of eight underground drill rigs and five surface drill rigs.

During the period, the Company’s ongoing historic data re-processing and targeting programs identified significant mineralized intercepts in over 75 historic drill holes drilled beneath the southern portion of the historic Pilar open pit mine in an area known as Baraúna. Confirmation drilling was undertaken during the period to confirm the mineralization ahead of the Company’s updated NI 43-101 compliant technical report and drilling remains ongoing.

Expansion and extensional drilling continued in a newly accessed area within the South Extension, where a new zone of mineralization was identified during the period, and in the Deepening Extension zone where a grouping of deep holes, including the deepest hole drilled in the Pilar Mine to date, all returned high-grade copper intercepts.

Drilling on the West Limb during the period was focused on infill and short-term drilling of the P1P2W mining area ahead of the Company’s NI 43-101 compliant technical report update. Exploration drilling on the West Limb is expected to resume following completion of infill and Baraúna confirmation programs. Currently, four surface drill rigs are undertaking exploration drilling at Baraúna while four underground drill rigs are continuing to define the Deepening Extension. The remaining four short-term core rigs are operating in the Deepening and P1P2W mining areas, while one drill rig is targeting regional exploration targets within the Pilar District.

Baraúna Discovery

The Company’s ongoing historic data re-processing and targeting programs identified significant mineralized intercepts in over 75 historic drill holes drilled beneath the southern portion of the historic Pilar open pit mine. During the period, drilling was conducted to confirm the extent of mineralization identified in the historic database with six confirmatory holes drilled into the newly identified zone. To date, the zone has been delineated over a north-south strike length of approximately 450 meters, varying thickness of up to 30 meters and from outcrop at the bottom of the open pit connecting to mineralization at depth in the Pilar Mine – validation of the historic database remains ongoing. For planning purposes, drilling of the zone is focused on an area that, on average, extends 110 meters beneath the southern limit of the open pit mine. Drilling during the period was performed from surface targeting mineralization beneath the southern portion of the open pit mine. For reference, the pit floor is located approximately 230 meters below surface at its deepest part.

Please see Figure 4 for collar locations and Figure 5 for a north-south long section of the Baraúna zone.

NSI indicates no significant intercept, based on cut-off grade of 0.18% copper reflecting the open pit potential. Drill holes were drilled from surface. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

South Extension

Within the Pilar underground mine, drilling of the South Extension from a newly accessed drill station, has delineated a wide zone of mineralization previously modeled as narrow lenses at the southern edge of the orebody. Drilling during the period resulted in a significant expansion of this mineralized zone in both thickness and grade. Drilling from the new drill station continues to target further expansion of this zone.

Please see Figure 6 for a north-south long section and Figure 7 for a level map showing collar locations of South Extension drilling within the Pilar Mine.

NSI indicates no significant intercept based on cut-off grade of 0.68% copper. The drill holes were drilled from level -173 in the Pilar Mine. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

The Deepening Extension

The Deepening Extension drilling is currently targeting mineralization on the East Limb of the Pilar Mine between level -725 and level -1250 approximately 1,200 meters to 1,700 meters below surface and approximately 100 meters laterally from the current level of the primary ramp (completed to level -890).

Drilling during the period focused on infill and continued testing of the deepest known extent of mineralization within the Pilar Mine. The results are highlighted by drill hole FC4885 that intersected 8.4 meters grading 4.02% copper and 6.9 meters grading 3.15% copper. This hole is significant as it was drilled approximately 50 meters south and 40 meters below the previously announced deepest intercept at the Pilar Mine in hole FC4986 (6.9 meters grading 5.82% copper and 15.4 meters grading 3.71% copper as outlined in the Company’s press release dated June 6, 2018). Additionally, drill hole FC48102 intersected 15.6 meters grading 3.25% copper approximately 50 meters above FC4885 (at the same level as the previously announced hole of FC4986), together providing continued evidence that the Pilar Mine remains open at depth, where high-grade mineralization continues to be encountered approximately 350 meters below the deepest level of current development at the Pilar Mine.

Please see Figure 8 for a north-south long section and Figure 9 for a level map showing collar locations of Deepening Extension drilling within the Pilar Mine.

NSI indicates no significant intercept based on cut-off grade of 0.68% copper. The drill holes were drilled from the -670 and -740 levels in the Pilar Mine. Holes not included are either pending assay results, have been included in a different section of this press release for clarity of discussing drill results or were previously included in a prior press release. The length of intercept may not represent the true width of mineralization. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

REGIONAL EXPLORATION

The Company has completed the data interpretation and targeting phase of the regional airborne geophysical survey comprised of both electromagnetic and gravity systems. To date, a significant number of high priority target areas have been identified and detailed analysis of each target area remains ongoing. Further drill testing of high-priority targets, located within the Pilar and Vermelhos Districts, remains underway, with one exploration drill rig allocated to a target south of the Pilar Mine and two drill rigs located on targets both south and north of the Vermelhos Mine.

NX GOLD MINE

The NX Gold Mine is a high-grade producing gold mine, located in Mato Grosso State, Brazil. The mine is currently producing approximately 40,000 ounces of gold and 25,000 ounces of silver per annum. Historic and current production occurs within two adjacent mineralized quartz veins located along a northeast trend approximately 600 meters apart, known as Brás and Buracão, which are accessed via a single portal and decline. Beginning in late 2018, exploration drilling commenced to evaluate down-plunge extensions of the Brás and Buracão veins, as well as test for mineralization between the two veins, which resulted in the recently announced Santo Antonio Vein discovery located between Brás and Buracão. The Santo Antonio Vein, to date, has been defined over a lateral extent of approximately 400 meters, a down-dip distance of approximately 200 meters and remains open to depth (see press release dated April 18, 2019 for detail regarding the Santo Antonio Vein discovery).

Currently, seven drill rigs are operating on the property. Please refer to Figure 10 for drill collar locations and Figure 11 for a east-west long-section of the NX Gold Mine. Drill hole ID nomenclature of BS, SA, BUS, and MA refers to Brás, Santo Antonio, Buracão, and Matinha, respectively.

NSI indicates no significant intercept, based on cut-off grade of 1.40 grams per tonne gold. Drill holes were drilled from surface. Holes not included are pending assay results. The length of intercept may not represent the true width of mineralization and reported intercepts reflect the entire thickness of the vein. Values may not add up due to rounding. From, to and mineralized intercepts are rounded to the nearest tenth of a meter.

ABOUT ERO COPPER CORP

Ero Copper Corp, headquartered in Vancouver, B.C., is focused on copper production growth from the Vale do Curaçá Property, located in Bahia, Brazil. The Company’s primary asset is a 99.6% interest in the Brazilian copper mining company, MCSA, 100% owner of the Vale do Curaçá Property with over 39 years of operating history in the region. The Company currently mines copper ore from the Pilar underground mine, the R22W open pit mine and its newly constructed Vermelhos underground mine. In addition to the Vale do Curaçá Property, MCSA owns 100% of the Boa Esperanҫa development project, an IOCG-type copper project located in Pará, Brazil and the Company, directly and indirectly, owns 97.6% of the NX Gold Mine, an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including Technical Reports on the Vale do Curaçá, Boa Esperanҫa and NX Gold properties, can be found on the Company’s website (www.erocopper.com) and on SEDAR (www.sedar.com).

QUALITY ASSURANCE / QUALITY CONTROL

Vale do Curaçá Property

The Company is currently drilling on surface and underground with core drill rigs using a combination of owned and third-party contracted drill rigs. During the period from March 2019 to May 2019 third party drill rigs were operated by Major Drilling, Layne Christensen Co., and DrillGeo Geologia e Sondagem Ltda., all of whom are independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at MCSA’s secure core logging and storage facilities. Half of the drill core is retained on site and the other half core is used for analysis, with samples collected on one-meter sample intervals unless an interval crosses a geological contact. Reverse circulation cuttings are split at the drill rig using one-meter sample intervals. All sample preparation is performed in MCSA’s secure on-site laboratory. Total copper is determined using a nitric-hydrochloric acid digestion and Atomic Absorption Spectrometry (“AAS”) and/or Titration. Oxide copper values are determined using sulfuric acid digestion followed by AAS. All recent sample results have been monitored through a QA/QC program that includes the insertion of certified standards, blanks, and pulp and reject duplicate samples. Regular check-assays are submitted to ALS Brasil Ltda’s facility located in Vespasiano, Minas Gerais, Brazil, at a rate of approximately 5%. ALS Brasil Ltda is independent of the Company.

NX Gold Mine

The Company is currently drilling on surface with third-party contracted core drill rigs. During the period from March 2019 to May 2019 third party drill rigs were operated by Major Drilling do Brasil Ltda. and Servitec Foraco Sondagem S.A. whom are independent of the Company. Drill core is logged, photographed and split in half using a diamond core saw at NX Gold’s secure core logging and storage facilities. Half of the drill core is retained on site and the other half core is used for analysis, with samples collected on half-meter sample intervals for quartz vein and one-meter intervals in surrounding rock unless such interval crosses a geological contact. Samples are sent to ALS Brasil Ltda.’s laboratory in Goiânia (Brazil) for preparation and are analyzed by the certified laboratory of ALS Peru S.A., whom are independent of the Company. Gold content was determined by fire assay in 2018. Commencing in January of 2019 gold content has been determined by both fire assay and screen fire assay. All recent sample results have been monitored through a QA/QC program that includes the insertion of certified standards, blanks, and pulp and reject duplicate samples at a rate of one standard, one blank, and one duplicate pulp sample per every 20 samples for a blended rate of approximately 5%.

Rubens Mendonça, MAusIMM, Chartered Professional – Mining, has reviewed and approved the scientific and technical information contained in this press release. Mr. Mendonça is a Qualified Person and is independent of the Company as defined by NI 43-101.

Signed: "David Strang"

David Strang, President & CEO

For further information contact:

Makko DeFilippo, Vice President, Corporate Development

(604) 429-9244

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS This Press Release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information includes statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Such forward-looking information includes, without limitation, statements with respect to the estimation of mineral reserves and mineral resources, the significance of any particular exploration program or result and the Company’s expectations for current and future exploration plans including, but not limited to, planned areas of additional exploration, timing of any updated technical reports and further extensions and expansion of mineralization near the Company’s existing operations and throughout the Curaçá Valley and NX Gold Mine.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this Press Release including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Vale do Curaçá Property, NX Gold MIne and the Boa Esperanҫa Property being as described in the technical reports for these properties; production costs; the accuracy of budgeted exploration and development costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Furthermore, such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking information. Such risks include, without limitation the risk factors listed under the heading “Risk Factors” in the Annual Information Form of the Company for the year ended December 31, 2018, dated March 14, 2019.

Although the Company has attempted to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially from those described in forward-looking information, there may be other factors that cause actions, events, conditions, results, performance or achievements to differ from those anticipated, estimated or intended.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

Forward-looking information contained herein is made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking information, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

GENERAL Information of a scientific or technical nature in respect of the Vale do Curaçá Property included in this press release is based upon the Vale do Curaçá technical report entitled “2018 Updated Mineral Resources and Mineral Reserves Statements of Mineração Caraíba’s Vale do Curaçá Mineral Assets, Curaçá Valley”, dated October 17, 2018 with an effective date of August 1, 2018, prepared by Rubens Jose De Mendonça, MAusIMM, of Planminas and Porfirio Cabaleiro Rodrigues, MAIG, Fábio Valério Cãmara Xavier, MAIG, and Bernardo Horta de Cerqueira Viana, MAIG, all of GE21 Consultoria Mineral, whom are independent qualified persons under NI 43-101. Information of a scientific or technical nature in respect of the NX Gold Mine included in this press release is based upon the Vale do Curaçá technical report entitled “Mineral Resource and Mineral Reserve Estimate of the NX Gold Mine, Nova Xavantina”, dated January 21, 2019 with an effective date of August 31, 2018, prepared by Porfirio Cabaleiro Rodrigues, MAIG, Leonardo Apparicio da Silva, MAIG, and Leonardo de Moraes Soares, MAIG, all of GE21 Consultoria Mineral, whom are independent qualified persons under NI 43-101.

Please see the relevant Technical Reports filed on the Company’s profile at www.sedar.com, for details regarding the data verification undertaken with respect to the scientific and technical information included in this press release regarding the Vale do Curaçá Property and the NX Gold Mine for additional details regarding the related exploration information, including interpretations, the QA/QC employed, sample, analytical and testing results and for additional details regarding the Mineral Resource and Mineral Reserve estimates discussed herein.

Cautionary Notes Regarding Mineral Resource and Reserve Estimates In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with the CIM Standards.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with Measured or Indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an Inferred mineral resource will be upgraded to an Indicated or Measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, Inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.